Kotak Assured Income Accelerator is a guaranteed income insurance plan that helps build the habit of regular savings over the time. This plan offers increasing guaranteed income year on year during the payout period. You can also get the life cover, so your family’s financial security is ensured. Get Quotes

In the event of death of the life insured during the term of the policy, Sum Assured on Death is payable to the nominee. Sum Assured on Death is higher of Basic Sum Assured, Guaranteed Maturity Benefit or multiple of annual premium. Where multiple is 11 times when age at entry is less than or equal to 50 years and it is 7 times when age at entry is 51 years & above.

The total death benefit is subject to the minimum of 105% of the total premiums paid.

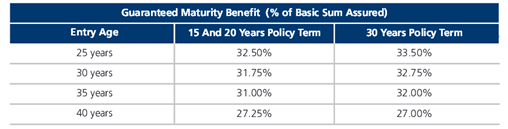

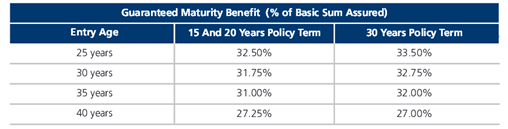

Guaranteed Maturity Benefit as a percentage of basic sum assured is payable at policy maturity. This benefit depends on the age at entry and the policy term chosen.

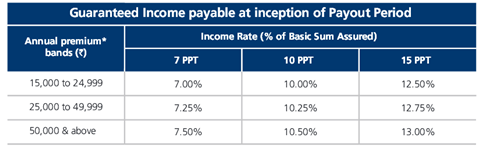

Survival Benefit as guaranteed income every year is payable during the payout period. The guaranteed income depends on the income rate that may increase with higher annual premium.

The guaranteed income increases every year by simple percentage of 5%/6%/7% for 7 years/10 years/15 years Premium Payment Term, respectively.

The maximum loan amount that can be availed is up to 80% of surrender value, subject to a minimum amount of Rs 10,000.

This policy acquires Surrender Value after payment of all the due premium for at least two full policy years for premium payment term of less than 10 years and the surrender can be acquired after payment of all the due premium for at least three full policy years for premium payment term of 10 years & above. The Surrender Value payable is higher of Guaranteed Surrender Value or Special Surrender Value.

Under this policy, you can avail tax benefits under section 80C & 10 (10D) of the Income Tax Act, subject to prevailing tax laws.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 0 Years | 60 Years (7/10 Years PPT), 55 Years (15 Years PPT) |

| Age at Maturity | 18 Years | 85 Years |

| Policy Tenure | 15/20 Years | 30 Years |

| Premium Paying Term | 7 Years (policy Term 15 Years), 10 Years (policy Term 20 Years), 15 Years (policy Term 30 Years) | - |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly | - |

| Premium Payment Option | Limited Only | - |

| Annual Premium | Rs 15,000 | No Limit (subject To Underwriting) |

| Basic Sum Assured | 10 Times Of Annual Premium | - |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

Following riders can be opted, on payment of additional rider premium.

Raman at 35 years, wants to buy Kotak Assured Income Accelerator to get regular money backs along with life protection. He opts the plan with the premium paying term of 15 years and annual premium of Rs 60,000.

Scenario A: Raman Survives the Policy Term

If Mr. Raman survives till the maturity of the policy term, he receives Guaranteed Maturity Benefit along with the last installment of Guaranteed Income. This maturity benefit helps meet your financial objectives.

Scenario B: Raman dies during the Term of the Policy

In the event of demise of Mr. Raman during the policy term, Sum Assured on Death is payable to the nominee. The death benefit provides a financial net to the nominee/family.

Benefit Illustration: